Option chain on NSE (National Stock Exchange of India) is a listing of all the available option contracts for a specific underlying asset traded on the NSE. NSE provides option chain data for various underlying assets such as equity stocks, index, ETFs, etc.

In the option chain on NSE, you can find the strike prices, expiration dates, and the current bid and ask prices for each option contract for the specific underlying asset. It is designed to allow traders to quickly view the available options, compare the different strike prices and expiration dates, and select the right option contract to trade.

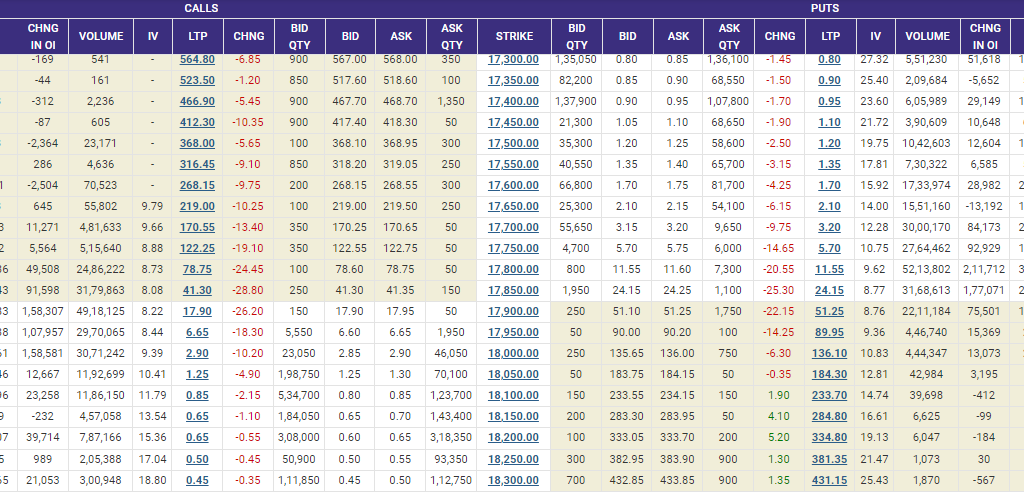

The option chain on NSE is usually presented in a tabular format, with rows representing option contracts and columns representing different details such as strike price, expiration date, bid price, ask price, volume and more.

The NSE also provides filter options to sort the options based on expiration date, strike price, and more, to help trader to find the right option contract to trade. The NSE option chain also gives the implied volatility, open interest and change in open interest, which are important indicators for option traders.

It’s important to note that not all the underlying assets have options available to trade, also the option chain will vary based on the underlying asset you are looking at and the type of underlying asset. Traders need to check the underlying specific and available options before trading in options.

In short, The option chain on NSE is a listing of all the available option contracts for a specific underlying asset traded on the NSE, which provides data such as strike prices, expiration dates, current bid and ask prices, implied volatility, open interest, change in open interest and more, to help traders make informed decisions.